January 10, 2011 – The Mad Hedge Fund Trader Interviews Charles Nenner in 2011

The Mad Hedge Fund Trader Interviews Charles Nenner in 2011 [59:59m]: Hide Player |Play in Popup | Download

The Mad Hedge Fund Trader Interviews Charles Nenner in 2011 [59:59m]: Hide Player |Play in Popup | Download

Featured Trades: (CHARLES NENNER ON HEDGE FUND RADIO),

(SPX), (SOX), (QQQQ), (EEM), (CSCO), (BAC), (BIDU), (XOM),

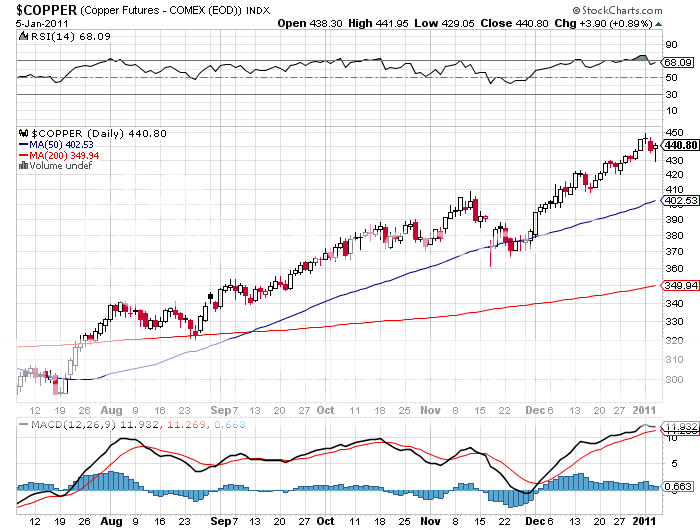

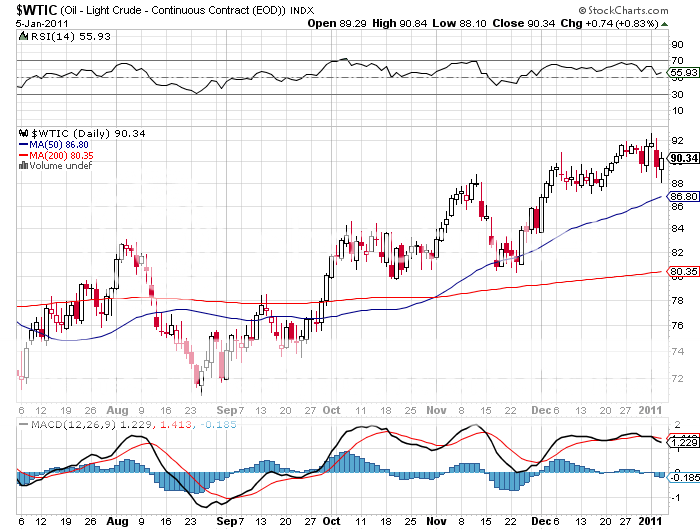

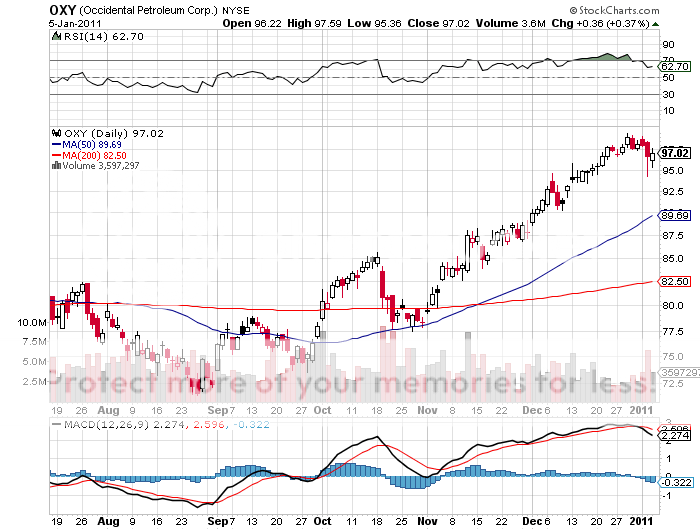

(CU), (OIL), (OXY),

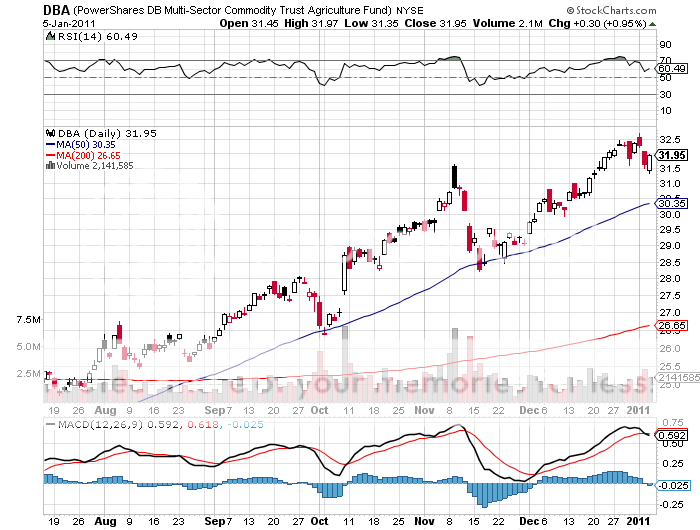

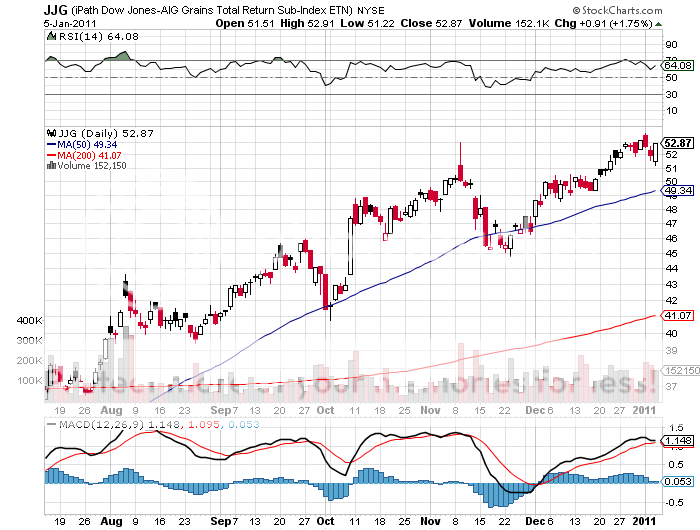

(WHEAT), (CORN), (DBA), (JJG),

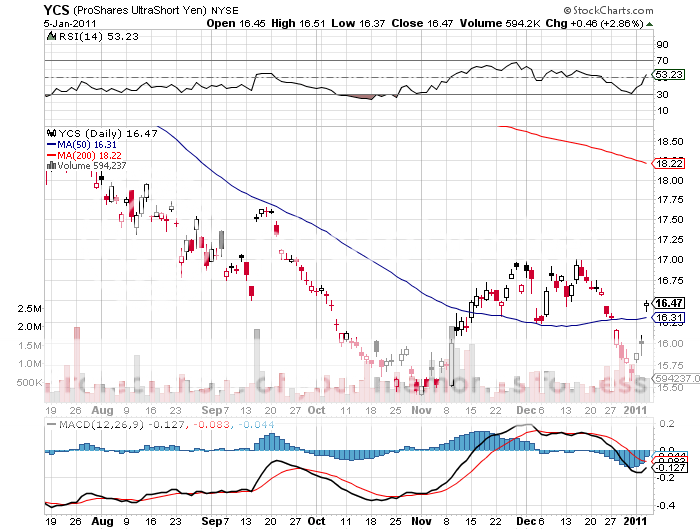

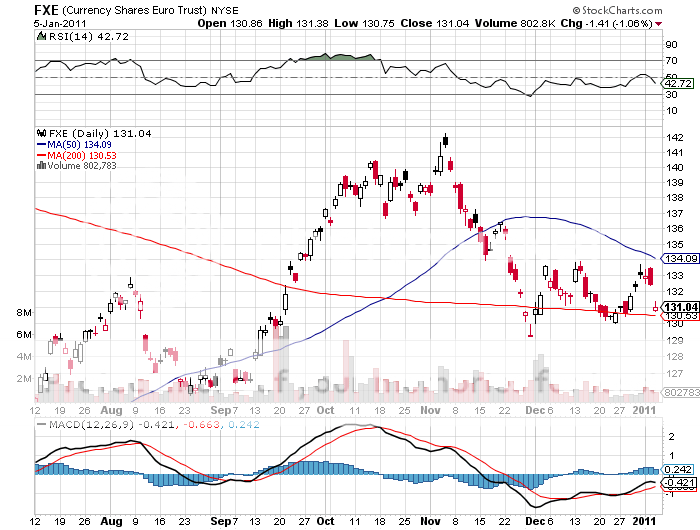

(FXE), (FXA), (FXY), (YCS)

My guest on Hedge Fund Radio this week is Charles Nenner of Charles Nenner Research in Amsterdam. Charles hails from Holland, and has a long career that includes stints at medical school, Merrill Lynch, Rabobank, and ten years at Goldman Sachs. He has spent three decades developing his proprietary Cycle Analysis System, which generates calls of tops and bottoms for every major market in the world.

Charles developed a huge following after 2007, when he accurately nailed the top in the Dow at 14,500 and urged his clients to put on short positions when everyone else was predicting that the market would keep grinding higher. I have been following Charles’ daily research reports myself for many years, and found them to be uncannily accurate. Most recently, Charles predicted the last sell off in stocks, missing the exact April 25 top by only one trading day.

Today, Charles Nenner counts major hedge funds, banks, brokerage houses, and high net worth individuals among his clients. You can find out more about Charles’ work at his website at www.charlesnenner.com. Today’s, Nenner gives us his technical view of the world’s major markets. Below, I have broken down Charles’ bespoke analysis by asset class.

-

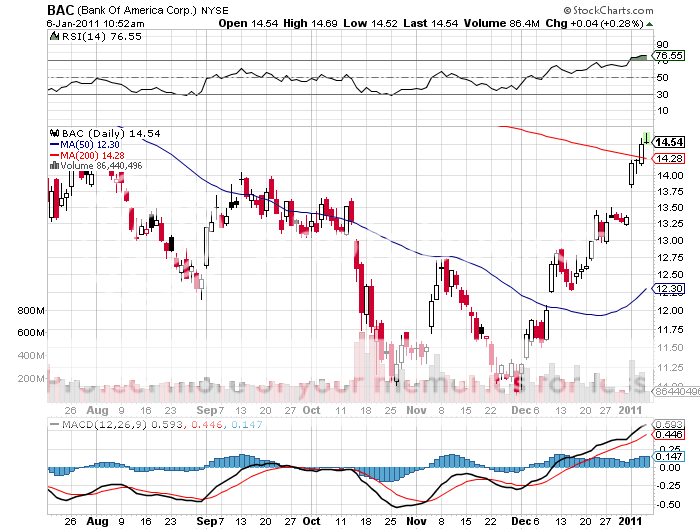

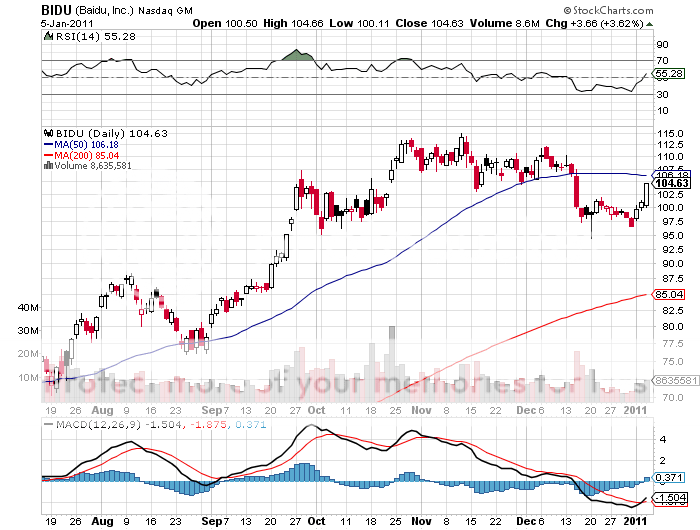

Equities

Nenner sees multiple peaks developing in a number of equity indexes coming at the end of January. He is still long the S&P 500, which could run as high as 1,480 in a best case scenario. He will sell his position if the SPX trades below 1248, or by January 25, whatever happens first. Germany and the US will be the equity markets of choice during 2011, while emerging markets are to be avoided. Bank of America (BAC) may have another week to run, maybe ticking at $14.70. Chinese Internet provider Baidu (BIDU) is a buy here at around $100 and may have another 20% left in it. Charles is not a believer in Cisco Systems (CSCO), so I wagered him a case of the fiery Dutch liqueur, Bols, on the outcome.

-

-

-

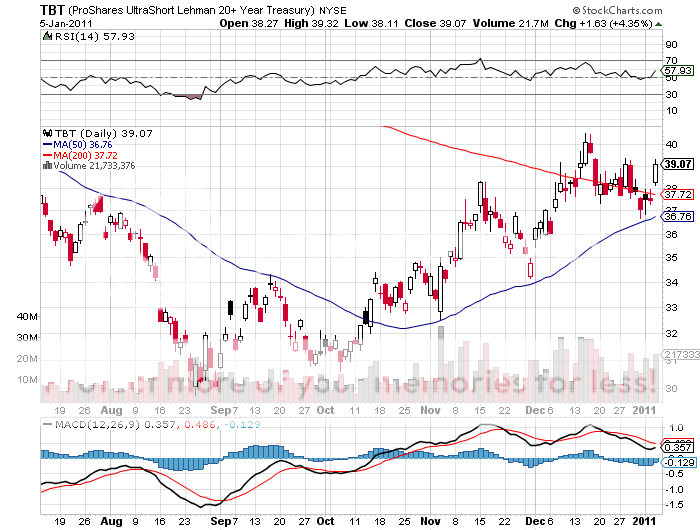

Bonds

The wily Dutchman sees an 18 month bear market in bonds that we all should be trading around. Ten year yields will balloon up from the current 3.40% to 4.20% and the 30 year may see as high as 5.30%. Then in 2013, he thinks we will see another dip in the economy, a resurgence of deflation, and a huge rally in bonds that will take ten year yields all the way back down to the 2010 low of 2.0%.

Longer term, he sees rates going up for 30 years, reaching the stratospheric 13% we saw in the early 1980’s. A great way to play this will be through the leveraged ETF (TBT). Short term he thinks we could pop back up to $41, where he wants to take a trading profit. After that, you should be buying every dip for the next 20 months.

-

Commodities

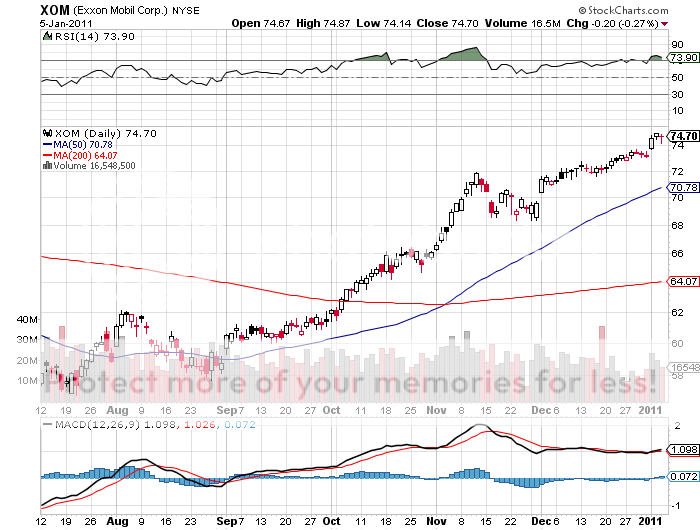

Nenner’s copper target (CU) is $4.82 by the middle of April, up XX% from today’s $4.40 . Other commodities have already seen most of their run. Regarding oil, he sees a short term top around $92, and wants to buy it back at the end of January around $85.50. His multiple year view has it going all the way up to $200, hence his pick of ExxonMobile (XOM) as a favorite equity play. Of the independent oil producers, Charles like Occidental Petroleum (OXY), which he thinks has another 10% left in it.

-

-

-

Grains

Nenner is hugely bullish on the grains, with wheat as his favorite. He argues that the essential foodstuff could rise as much as 38% to $13. Corn is looking good on the charts. His views reinforce my own theory that the world is making people faster than the food to feed them. Short term, the agricultural ETF (DBA), is peaking, but long term could reach much higher. The grain ETF (JJG) should appreciate until April and could print $56.20, and could keep running all the way into 2013.

-

-

-

Currencies

There is weak rally in the euro to $1.35, where he wants to sell it for a move to the $1.10’s. The Australian dollar (FXA) is reaching a major long term top, and tighter stops are warranted. The Japanese yen (FXY), (YCS) is on the verge of making a major long term high, and Charles is looking for good entry points on the short side. An initial 22% depreciation from ¥82 to ¥100 is doable in 18 months, and could take the (YCS) up 44% from the present $16 to $23.

-

-

Precious Metals

Gold is also topping around $1,440, as is silver around $31. The barbarous relic looks a lot more interesting around $1,000. He is buying deep out of the money puts on the gold ETF (GLD) for pennies, looking to make a killing on the coming sell off.

-

Summary

What would Nenner do with the new money he received today? What are the cleanest trades out there? It’s very simple. He would sell the next two point rally in bonds through buying the (TBT). He would buy any dips in the grains, crude and the dollar against the Euro. He would sell any breakdown in the Australian dollar. Finally, he would be laying on big shorts in the Japanese yen right now.

To listen to my interview with Charles Nenner on Hedge Fund Radio in full, please click here.

No comments:

Post a Comment